Investment Management

A factor-based approach to portfolio management that builds sustainable wealth & ensures financial security.

You can’t beat the market – but you can capitalize on its known behaviors.

There are three key points to understand about investing:

Study after study has found that it’s impossible to beat the market on a consistent basis; if you try it, you’ll lose. That is why F5 Financial’s investment planning and wealth management approaches investing with a data-driven, factor-based methodology. Instead of trying to outsmart the market, we use known market behaviors and leverage DFA funds to create an investment strategy to meet your goals.

In addition to using known market behaviors as investment indicators, we take a holistic approach to your wealth management that considers all aspects of your financial welfare. Each strategy is customized to the client and their unique financial objectives. We create a strategy that maximizes your cash flow and assets for investing while ensuring you have enough liquidity to always be secure.

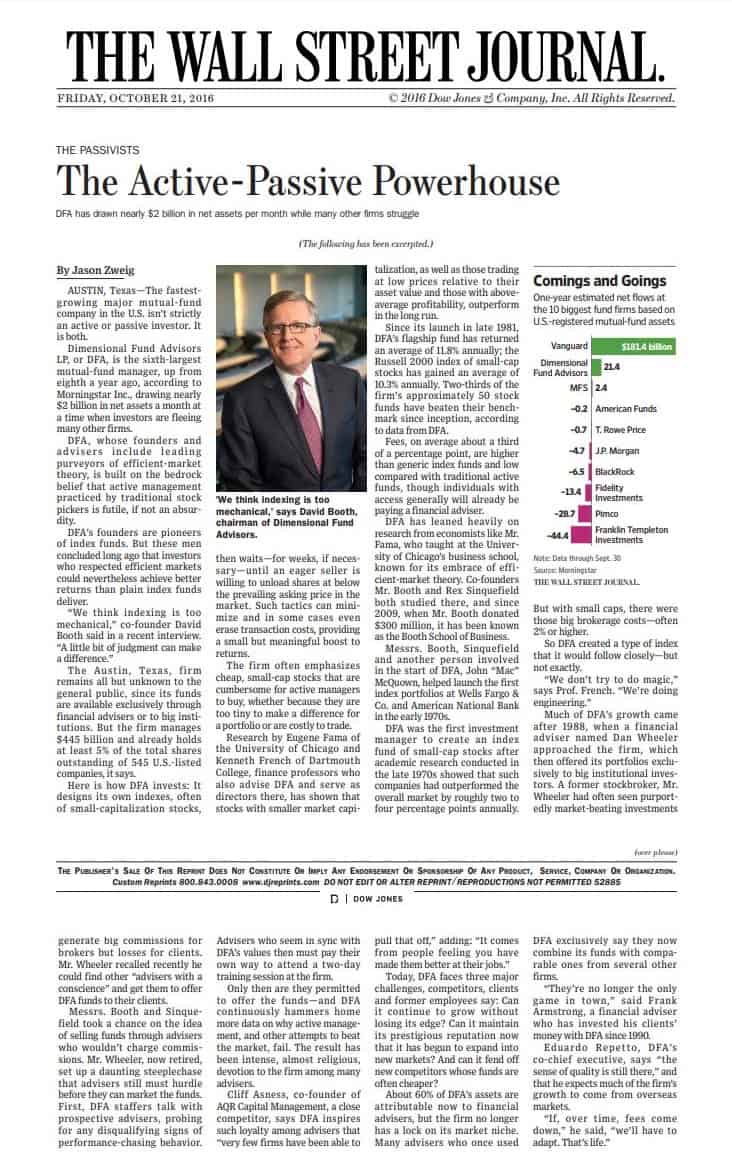

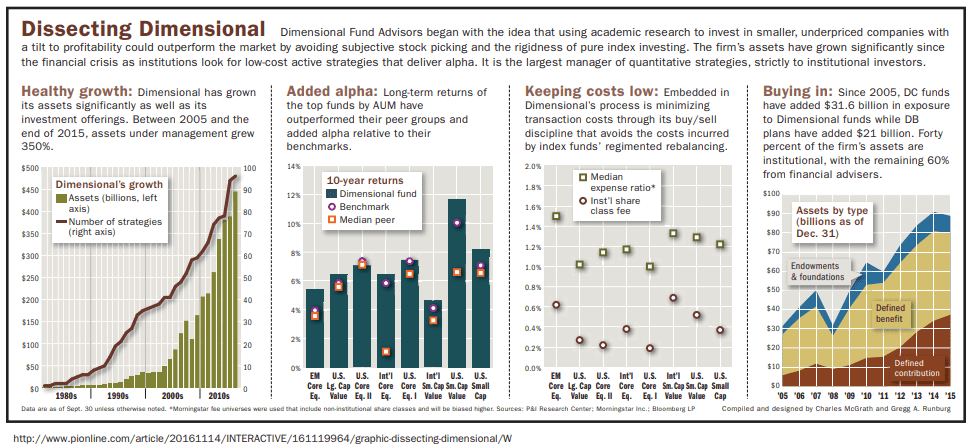

DFA Funds: A Superior Approach to Investment Management

At F5 Financial, we use the investing methodology developed by Eugene Fama, an economist and winner of the Nobel Memorial Prize in Economic Sciences. Fama’s methodology focuses on capturing the “key” dimensions of the marketplace as investment indicators. These dimensions are:

F5 Financial is an approved advisor with Dimensional Fund Advisors, an asset manager whose mutual funds use Fama’s dimensional methodology. As an approved advisor with DFA, we can invest our client’s portfolios in DFA’s mutual funds, which are not available to the general public.

F5 Financial’s Investment Planning Process

Goal Planning

Our initial meeting will discuss your financial goals. Is the purpose of your portfolio to save for retirement? To build a trust for a loved one or charitable organization? Learning what your intent is with your gains will help us develop a robust investment strategy.

Cash Flow Planning and Analysis

We assess your current and anticipated income, and then model what needs to happen from a budgetary and growth standpoint to meet your goals.

Investment Strategy

Using a factor-based approach that leverages DFA funds, your investments are optimized for growth. We create a diversified portfolio that performs well across market cycles.

Financial Projections & Quarterly Reports

We produce financial projections for your investment portfolio and deliver quarterly reports that show where you’re at with your financial goals.

Ready to find out more?

Contact us to speak with a fee-only financial planner about your investment portfolio.