How Are DFA Funds Different From Index Funds?

By: Curt Stowers

Updated: September 15, 2021

Interested in investing in DFA Funds? Contact F5 Financial to learn more

When it comes to investing, there are countless different strategies, and that is great. It creates a wonderful market that allows investors to pursue a strategy with which they are comfortable. However, most of these strategies are based on feelings and emotions versus facts and data. Here we will go through the differences between conventional investment management, indexing, and Dimensional Fund Advisors (DFA)’s “dimensional” approach to investing.

What is a DFA Fund?

A DFA fund is a type of investment fund that is based on “dimensional” attributes. DFA stands for Dimensional Fund Advisor, and the dimensions that impact their investment strategy include:

- The equity premium – Stocks perform better than bonds over the long term

- The size premium – Small companies outperform large companies over the long term

- The value premium – Value companies outperform growth companies over the long term

- The profitability premium – More profitable companies outperform less profitable companies over the long term

The other two approaches to investing – Conventional Investment Management and Indexing – do not consider these attributes for the strategy and are based on other factors.

OVERVIEW OF

CONVENTIONAL INVESTMENT MANAGEMENT, INDEXING & DFAs

| Conventional Investment Management | Indexing | Dimensional (DFA) |

|---|---|---|

| • Attempts to identify mispricing in securities | • Allows a commercial index to determine the strategy | • Uses insights about markets and returns from academic research |

| • Relies on forecasting, security selection, and market timing | • Attempts to closely track the benchmark | • Structures portfolios along the dimensions of expected returns |

| • Generates higher expenses and trading costs, and excess risk | • Accepts lower returns, reduced flexibility, and higher trading costs | • Adds value by integrating research, portfolio structure and implementation |

How does conventional investment management work?

Conventional investment management is predicated on the theory that there are money managers who can pick the winners for you. This approach preys on our desire to “win” – who can argue that it’s better to win than to lose? While I agree that it is better to win than to lose, finding the winning investment manager is quite a challenge. In particular, any time you buy or sell a security, there is someone on the other side of the transaction that thinks they are winning and you are losing. They cannot both be right.

Hence, when we choose a conventional investment manager, we are actually saying that he will be smarter than all of the other folks that are on the other side of the transaction. Does it really makes sense that you are going to pick the best investment manager OR is it more likely that you are going to pick the investment manager that does the best job of MARKETING himself or herself?

To answer this question, you need to look no further than the numbers. Study after study has shown that conventionally managed funds fail to outperform passively managed funds.

This revelation that conventional investment management is not able to outperform the market, gave rise to the concept of index investing. Index investing does NOT try to beat the market. Rather, it does everything it can to CAPTURE the market return. Using an indexing investment management approach in conjunction with a solid asset allocation plan is one of the easiest and best ways to approach investing. There are, however, a few challenges associated with the use of index funds:

How does index investing work?

Indices are commercial creations. As such, they are created at a moment in time and remain static until changed by the creator. Unfortunately, if you are looking to capture a certain asset class by the use of an index fund, you will find that the index drifts over time; and, in so doing, does not allow you to capture the targeted asset class.

There are a large number of indices available that look to “capture” some asset class. Each of these is slightly different and each of these has slightly different performance/results. That presents a challenge to the investor in deciding which index to follow.

The “holy grail” for an index fund is to have zero tracking error (i.e. exactly match the performance of the targeted index). While that is a solid goal, it is not attainable as the fund manager would need to match every trade, every day. Further, there are certain times (e.g. when a security enters or leaves the index) that following the index directly will be sub-optimal.

While these challenges are not insignificant, in my opinion using an index strategy is superior to the conventional investment management strategy.

Ready to Start Investing in DFA Funds?

Schedule a meeting to speak with a fee-only financial planner.

How do DFA funds work?

That brings us to the third approach that is used by Dimensional Fund Advisors (DFA). Unlike the index funds, Dimensional Fund Advisors do NOT rely on a commercial index. Instead, the folks at DFA have leveraged the Nobel Prize-winning work of Eugene Fama and Kenneth French to take a slightly different approach to investing. As mentioned before, they focus on capturing the key “dimensions” that have been identified as existing in the marketplace. These dimensions include:

- The equity premium – Stocks perform better than bonds over the long term

- The size premium – Small companies outperform large companies over the long term

- The value premium – Value companies outperform growth companies over the long term

- The profitability premium – More profitable companies outperform less profitable companies over the long term

Based on Fama and French’s academic work, DFA has implemented a systematic approach to identify each of these premiums and has utilized this approach to construct their investment funds. The fact that DFA uses a data-driven approach that exploits persistent and pervasive dimensions is the primary reason that I prefer this approach. However, there is one additional reason that I prefer this approach:

- It passes the “sniff test.” By the sniff test, I refer to whether or not something makes sense to me.

Each of the above premiums makes sense intuitively:

- I would expect owners (stocks) of companies to outperform lenders (bonds) to companies.

- I would expect small companies to have a better prospect of performing over the long term than big companies (yeah I love Apple, but how big can it get?)

- I would expect value companies to outperform growth companies (sure Facebook did great, but once upon a time there was this thing called MySpace. . .)

- I would expect well run companies (more profitable) to outperform poorly run (less profitable) companies

Personally, when I find something that has its foundation in the facts AND it makes sense intuitively, I am inclined to pay attention.

DFA and dimensional investing also differ from index funds in the implementation strategy. Again, the index fund is targeted at mirroring the underlying index. Stability and consistency are critical to success; however, rigid adherence to principles is often sub-optimal. DFA has the flexibility to deviate from a rigid index. As a result, there are several techniques used in the actual implementation of their funds. These include:

- Maintaining Asset Class Consistency – On a daily basis, each holding is evaluated to ensure that it continues to match with the underlying asset class that the fund is targeting.

- Managing Momentum – Stocks do exhibit momentum in the short term. As a result, a small delay in selling when positive momentum exists and buying when down momentum exists has the potential to add value.

- Managing Trading Costs – By focusing on explicit costs (commissions, custody fees, and exchange fees) and implicit costs (bid/ask spread and market impact) trading costs can be minimized.

- Integrated Portfolio Implementation – By balancing the expected premium of the dimension with the expenses associated with turnover, implementation costs are minimized.

- Securities Lending – As the owner of a large amount of securities, DFA takes advantage of this position to “lend” securities to others in the market.

Finally, DFA funds are different than index funds in that they require investors to work with an advisor versus having direct access to the funds. There are two reasons for this:

By going through advisors, DFA is able to minimize the impact on the flow of funds in and out of their funds. This helps DFA to avoid having to sell or buy at the wrong times.

DFA believes that most investors are better served by working with a financial advisor.

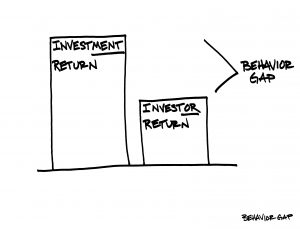

No doubt some folks reading this will find these last two points to be self-serving as I am a comprehensive, fee-only advisor. Fair enough. I would offer that for those individuals who (i) have spent the time to understand the financial planning process, (ii) fully understand the theory and mechanics behind portfolio construction, (iii) have the discipline to develop and implement an IPS, (iv) have the time to devote to their financial plan, and (v) have the ability to avoid poor behaviors associated with their emotions, the services of a financial planner may not add any value. However, as a rule, a great number of individuals will benefit from using an advisor to help them with their investment decisions The Behavior Gap (click here to see what WSJ has to say on the topic).

Hopefully, you have taken away a few ideas after reading about the differences in these three approaches to investing. Furthermore, hopefully, you will use the information provided to evaluate your approach to investing and make the necessary changes. Finally, if you have any questions about the topics covered in this article, feel free to reach out to me at any point in time. I enjoy working with entrepreneurs, corporate executives, and families to define their goals and make sure they have plans in place they are executing to achieve those goals.

Ready to Start Investing in DFA Funds?

Schedule a meeting to speak with a fee-only financial planner.

Would You Like More Support?

- Do you have a well-defined Investment Policy Strategy that is used to drive your investments in support of a comprehensive financial plan?

- If not, would you like to partner with someone who is used to helping people get through these struggles and (then, with confidence) implement portfolio strategies in a systematic manner while focusing on your desired outcomes?

If so, feel free to send us an email or give us a call. We’d love to have the opportunity to help you find a bit more peace of mind when it comes to investing.

Image credit: Joshua Mayo via Unsplash

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving