GUIDE: How to Build Generational Wealth

At F5 Financial, we tend to attract—and admittedly, seek—clients who want to do more with their money than just grow it exponentially. Our clients are typically goal-oriented, with a desire to have their portfolio’s growth support those goals. One of the top goals we hear from clients is that they want to make sure their money has a legacy. They want to build generational wealth.

If you’re interested in building—and preserving—generational wealth, there are specific steps you should take. In this article, I provide a guide with visuals for how to build generational wealth, and the actions you need to take to make sure it survives well after you’re gone.

What is Generational Wealth?

Simply put, generational wealth is wealth that grows and is available for generations to come. This wealth includes all portfolio assets, such as stock and real estate investments, business ownership, property with meaningful monetary value, and of course, money in the bank. But instead of this wealth providing for only you or your direct heirs, it’s managed in such a way that it produces continuous returns with dependable value for generations to come.

Why is generational wealth important?

Nick Murray, a financial advisor who has written extensively about helping clients achieve their goals through financial wellness, encourages financial advisors to ask the following during the discovery process with new clients:

"What do you most hope will happen financially, over the balance of your lives, and what do you most fear will happen?"

The truth is, generational wealth is not important to everyone. It’s not important to the person who is concerned with material items, or the person who just wants to have more money than their neighbor.

Generational wealth is important to the person who has love for others and wants to support that love with their money. It may be a love for your family, it may be a love for certain groups, but the common denominator for anyone interested in building generational wealth is love.

If you ask yourself the question posited by Nick Murray, you’ll come to know if generational wealth is important to you. If your biggest financial hope is that by the end of your life you have enough money to own a bigger boat than the guy next door, generational wealth likely isn’t a concern of yours. But if your top financial hope is that your children, or your children’s children, or even groups in your community, can have fewer worries about money, generational wealth is a clear priority.

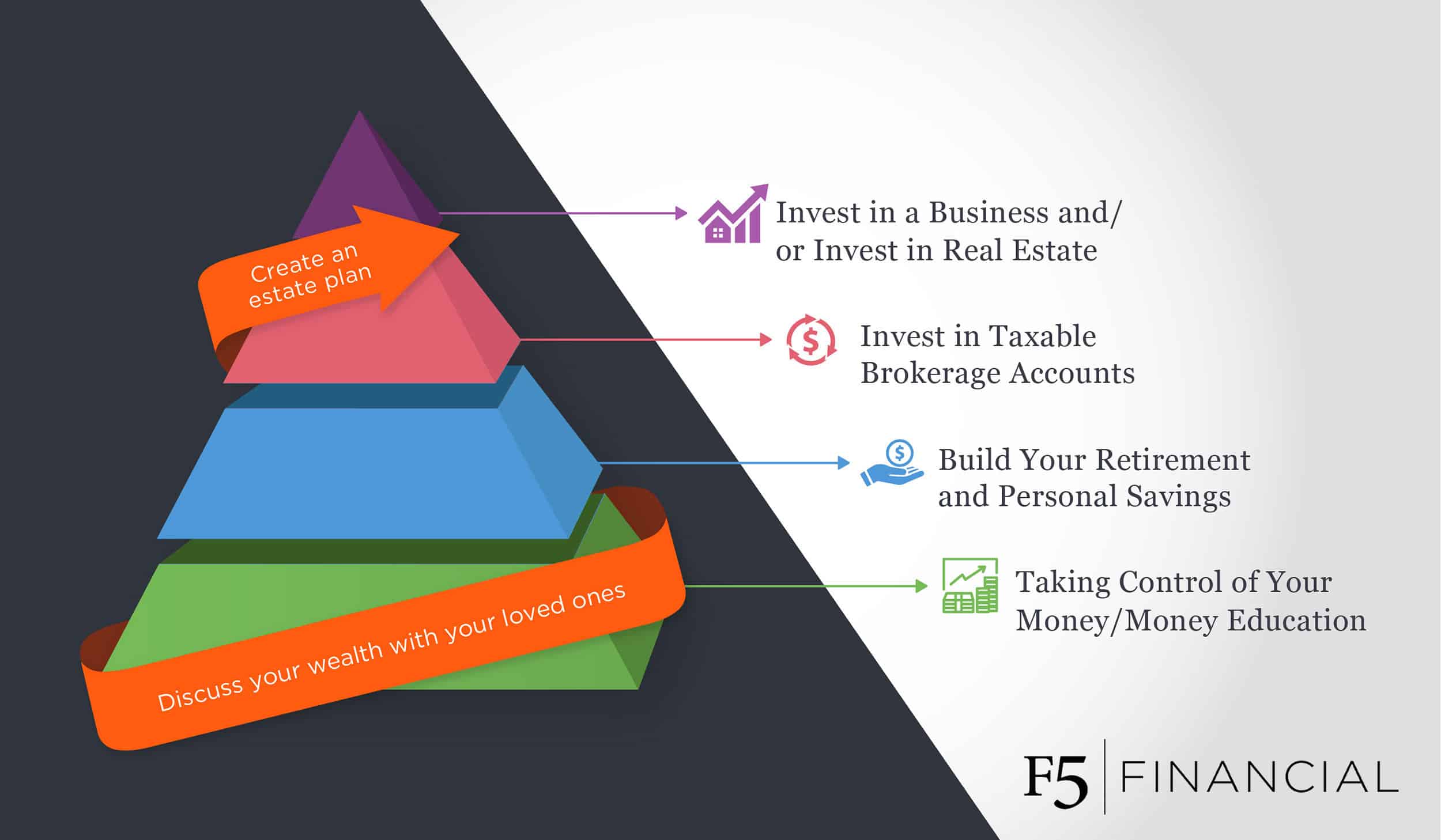

Steps for Building Generational Wealth

If you know generational wealth is important to you, here are my recommended steps and actions for building it.

- Take Control of Your Money Instead of Letting Your Money Control You

Step 1 is the foundation for building generational wealth.

In Dr. Thomas J. Stanley’s best-selling book, Stop Acting Rich…And Start Living Like a Real Millionaire, he talks about the three types of wealthy people: The Glittering Rich, the Wealthy Affluent, and the Balance Sheet Rich.

It’s this third type – the Balance Sheet Rich – that you should aspire to be if you want to build generational wealth.

The Balance Sheet Rich have their wealth on paper. They don’t display their wealth by purchasing expensive things (like the Glittering Rich), and they don’t spend more than they make, leaving them with an empty bank account despite their high income (like the Wealthy Affluent). They understand their income, make a budget, then make smart choices about how to use their money.

The Balance Sheet Rich have full control of their money, and that is how they build generational wealth. To develop this kind of control, you need to be educated on money management; whether it be from a financial planning book, a class, or by speaking with a financial advisor, you need to be informed about the power your money offers if it’s managed in the right way. So, to take control of your money, you need to seek out ways to be educated about money management.

- Build Your Retirement and Personal Savings

Once you have a firm grasp and understanding of your income and budget, the next level toward generational wealth is saving—saving for retirement and building personal savings that can be used in case of emergency. Saving for retirement and emergencies doesn’t sound sexy, but it is a necessary next step to generational wealth—if you do not have the funds to buoy yourself, you’ll have no chance of building wealth to help others.

There are many ways to save for retirement, like through an employer-sponsored 401k or by establishing a Roth IRA. As for your emergency fund, a good rule of thumb is that you save six months’ worth of living expenses.

- Invest in Taxable Brokerage Accounts

After you’ve built a decent nest egg and emergency fund, you should begin investing in taxable brokerage accounts, where you can use extra income to invest in the stock market and mutual funds. This strategy has a low barrier to entry – all you need is a no-fee online brokerage account and a little bit of money to start investing – and the stock market has a great track record if you invest for the long-term. If you decide to do self-directed investing, for best results you should set up automatic investments, where money automatically withdraws from your bank account and invests in the indices or funds you’ve chosen.

- Invest in a Business and/or Invest in Real Estate

Now that you have your retirement and emergency savings built up and you have cash in the stock market, it’s time to diversify extra money by investing in a business or real estate.

If you have a passion for starting a business, creating a vehicle for earning money is a great way to pass wealth to the next generation. If you don’t have a passion to build your own business, you can still diversify by investing in someone else’s business, provided it has a proven track record and you’ve done your research to ensure it’s on a healthy footing.

You can also invest in real estate. Real estate is fairly reliable in its potential for value growth and can provide steady cash flows over time. If purchasing real estate for the purpose of leasing it doesn’t appeal to you, you can consider buying a real estate investment trust, or REIT, which is like buying stock in property (instead of owning it completely).

These four steps, in this order, are a great pathway to building generational wealth. But generational wealth is only generational if it outlasts your lifetime. To ensure that your wealth will provide for your heirs and beyond, you need to take steps to preserve it.

How to Preserve Generational Wealth

- Create an Estate Plan

We have a saying at F5 Financial: “We believe that your family or community organizations will put your money to better use than the government.”

What we mean by this is, if you don’t make a plan for what will happen to your money after you’re gone, it will likely be taxed at a higher rate than necessary. There are various ways to reduce your estate’s tax burden – whether it be through tax planning or donor-advised funds – that will ensure more money gets into the hands of the people you want to have it, and not Uncle Sam.

Your estate plan also needs to address how you want your wealth passed on. You know your heirs best, and you may need to make tough decisions about who gets control over your assets if you want to make sure their full value is reached after you’re gone.

- Discuss Your Wealth with Your Loved Ones

To ensure the wealth you have built continues to build for generations to come, it’s important to discuss your wishes with the people set to inherit it. Just like you took the time to educate yourself about money, it’s important for your children, and your grandchildren, to do the same. When they have an understanding of the power of a well-managed portfolio, talk to them about your family’s wealth, how to grow it for the long-term, and why it should be protected and nurtured beyond your lifetime and throughout theirs.

If you are interested in speaking with a fee-only financial advisor about building generational wealth, please contact F5 Financial or book a call with me.

Blog post from this past week: