Should My Aging Parents Put Their House in My Name?

Are you helping older parents with financial decisions?

Today the Fearless Advisor reviews the financial (legal, tax, Medicaid) outcomes of putting your parents’ house in your name.

(The video is 3 minutes. Full transcript is below.)

Full Transcript of Video

Hey friends, the Fearless Advisor here. Today I am going to discuss if your parents should put their house in your name.

When discussing estate planning with clients, it is common for the topic of putting their parent’s house in their name to come up. Typically, this topic arises in hopes to avoid the government taking their parent’s home should they need extensive medical care.

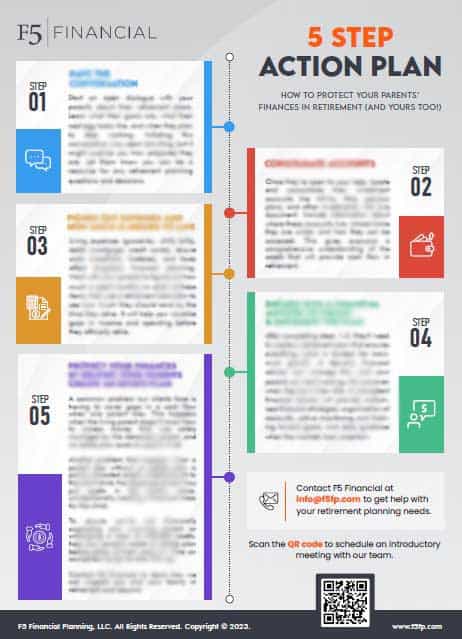

Download Your Free Action Plan

5 Step Action Plan

How to Protect Your Parents' Finances in Retirement (and Yours too!)

Download Your Free 5 Step Action Plan

Why should I keep my parent’s house in their name?

What is the purpose of leaving your parent’s house in their own names? The main benefit for inheriting your parents’ home when they pass is to realize the stepped-up cost basis. The cost basis is the amount paid for the home, which includes many improvements made over the years. This is different from the market value of the home, which is typically higher than the cost basis. When a home is inherited, the cost basis is reset to the market value of the home on the date of passing.

The cost basis steps-up to the market value on the date of passing.

The value of the step-up in cost basis is reduced or eliminated taxes if you plan to sell the home. Taxes are assessed on the difference between the cost basis and the market value. When the cost basis and the value are equal, as they are after inheriting the home, the tax bill be next to nothing.

Transfer of ownership = transfer of cost basis.

Now, if your parents use a quitclaim deed to transfer ownership of their home to you while they are still living, there will be a different set of tax consequences. When ownership is transferred so is the cost basis. This means that your parent’s home is now yours. If you sell the home at any time in the future, regardless of whether or not they have passed, you will pay tax on the difference between the cost basis and the market value.

Medicaid looks back five years for major financial transactions.

Good reasons exist to transfer ownership of a parent’s home to their children while still alive. However, like many situations, it is best to understand the situation and consequences of this decision. If the goal is to reduce your parent’s assets so they can qualify for Medicaid, remember that Medicaid will review financial transactions over the last five years. When they see the ownership of a home transferred, they require the value of the home be used toward your parent’s care before they can be covered by Medicaid.

Avoid quick, emotional decisions.

Helping your parents with their financial needs late in life can be a challenging endeavor. There are many laws and rules to navigate, all while time may not be on your side. Our emotions do not always help us make the best decisions. You may need to engage a financial advisor, estate attorney, and elder law attorney. These professionals should work together to help design the best way forward for your family.

F5 Financial is here to listen and to help you make the best decision for your family.

If you need assistance in this area, we would be happy to listen and support your family. Feel free to reach out to us at F5 Financial Planning. Thanks for joining us!

Photo credit: F5 Financial

Most recent Fearless Advisor video post:

Should You Get Out of the Stock Market?

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving