Factor-Based Investing – The Value Premium

Decades of academic research have identified that there are systematic differences in expected returns based on what is commonly referred to as factors. We can exploit these factors to structure portfolios to target higher expected returns. An example is the value premium.

Persistent and Pervasive Factors

While there is no guarantee that these factors will continue to outperform over time, empirical evidence has suggested that these factors have been persistent (i.e., occurred over time) and pervasive (i.e., occurred over the equity markets in various geographical regions).

The 4 “Premiums” of Return

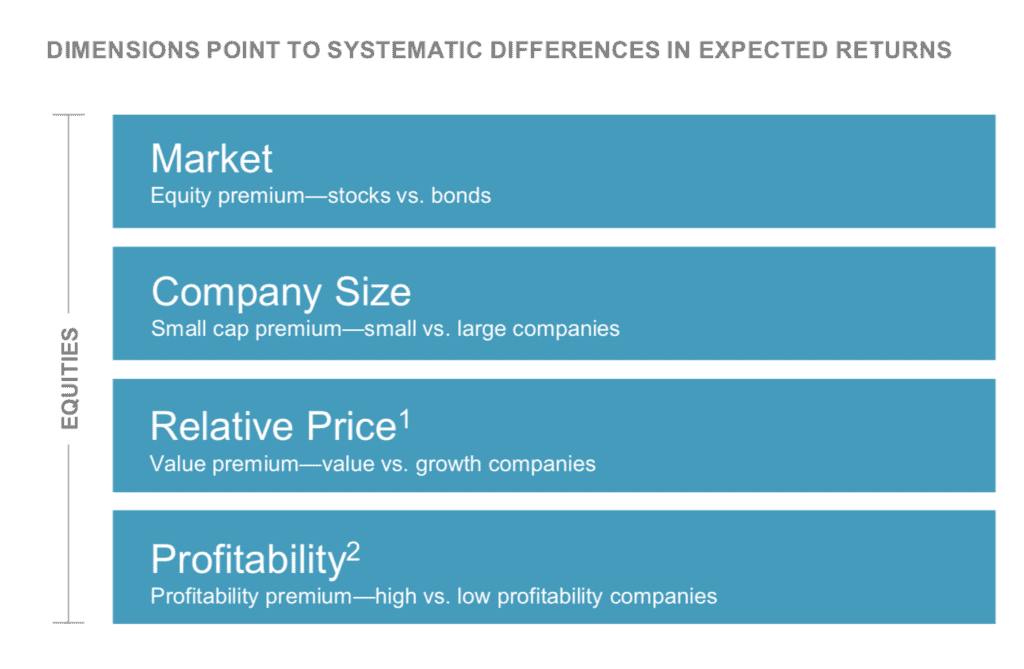

Over the next several weeks, we are discussing the four factors that have been shown to be persistent and pervasive. These factors give rise to “premiums” of return. These premiums are:

- Equity premium

- Small cap premium

- Value premium

- Profitability premium

The 5 Qualities

To be considered a dimension of expected return, a premium must be all of the following:

- Sensible

- Persistent

- Pervasive

- Robust

- Cost-effective

This Week: The Value Premium

This week we are going to take on the value premium. The value premium is based on empirical evidence (i.e., data) that suggests that companies with a smaller “relative price” will outperform companies with a larger “relative price.”

The Value Premium – Understanding The Difference Between Price And Value

Would you pay $100 for the iPhone 11 that just came out? How about $500? $1,000? $1,500? $10,000? Apple KNOWS your answer to this question and prices their latest phone appropriately. As a whole, let’s assume that the “value” you get out of a phone is “1 value unit.” That being the case:

- At $100, you get $100 per value unit

- At $500, you get $500 per value unit

IF the value that you get is constant, the relative price of the phone is higher the more that Apple raises the price. Now suppose that there are two users. One gets “1 value unit” and the other gets “5 value units”

- The two users would see equal “relative price” at $100 and $500 respectively for the phone

The value premium in the market works as follows:

- The price is established by the market.

- The scaling factor (what you divide by) is the book value of the company (essentially how much the assets of the company would cost to replace).

Understanding Relative Price

The value premium states that companies with lower relative prices outperform companies with higher relative prices. Think of it this way:

- Two companies are each trading for $100 in the stock market

- One company has a book value of $1, the second a book value of $5

- The relative prices are $100 / $1 = 100 and $100 / $5 = 20

- The value premium suggests that the second company—on average —will outperform the first.

In the market, price fluctuates each day based on the information available to the market participants. The book value of the companies remains relatively constant from day to day. Therefore, it’s the price that is key to understanding the value premium. In essence, what is happening is for two companies, in the same industry, with the same book value, and the market is speaking through price that one has more GROWTH potential (the one with the higher relative price). The data suggests that over all the stocks, the VALUE companies will actually outperform the GROWTH companies ON AVERAGE.

Why Do People Debate The Value Premium?

Of all the premiums, this is the one that I have seen cause the most debate. Turning back to Apple (or Facebook, or pick your favorite tech company sweetheart), you see that the market frequently becomes fond (vis-à-vis a high relative price) of certain stocks. At times, these valuations can become VERY large. However, these companies are often amazing and ones that we love. As a result, we (the market) “believe” in them and keep buying—which drives the price up.

Why The Value Premium Suggests It’s Better To Buy Railroad Stock Than Apple Stock

Because we see Apple and Facebook do so well, many are led to believe that the GROWTH companies are the way to go. In reality ON AVERAGE the VALUE companies outperform. The value companies are often stodgy and boring (think of railroads). On average, you are better off seeking out VALUE when you go to the market.

Hopefully, the above explanation helps you to better understand the value premium.

The Value Premium – Both Persistent And Pervasive

The value premium is persistent and pervasive. For that reason, a portfolio that “overweighs” or “leans” into value companies has been shown to have a higher expected return over the long run.

In Two Weeks, The Final Premium (HINT: Show Me The Money!)

In two weeks, we will go through the profitability premium. This premium will also have a logical, easy-to-understand explanation that backs up what the academics have found. For this reason, I have a high degree of confidence in using a factor-based approach to investing, which is built on leveraging these premiums.

You can also “read ahead” by jumping to this link which contains a PDF file going into more detail on this topic.

Would You Like More Support?

- Do you have a well-defined Investment Policy Strategy that is used to drive your investments in support of a comprehensive financial plan?

- If not, would you like to partner with someone who is used to helping people get through these struggles and (then, with confidence) implement portfolio strategies in a systematic manner while focusing on your desired outcomes?

If so, feel free to send us an email or give us a call. We’d love to have the opportunity to help you find a bit more peace of mind when it comes to investing.

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving