Is the IRS discouraging your generosity?

Is the IRS preventing you from being as generous with your gifting as you want to be?

During the holiday season, many of us spend lots of time thinking about others and what kind of gifts we want to give our loved ones. Often this can be a special piece of jewelry or clothing for an adult, or the special toy your child has been pining for all year.

While the latest Xbox video game or the hottest new Littlest Pet Shop figurine is a small-scale gift that brings joy to a child for a few days or weeks, at the other end of the spectrum are large-scale gifts of money, securities, or other expensive pieces of property.

These larger gifts may be part of an estate-planning strategy or a life-changing gift, designed to transfer wealth between parties, but each has the potential to bring the enigmatic gift tax into play. None of us want to have the IRS be the proverbial Grinch when planning our gifting strategies, so it is important to understand the rules.

The giver is responsible for paying any applicable gift tax,

even though they are the ones giving the wealth away.

Many of us are under the impression that there are annual limits to gifting, and there will be a tax owed each year after that annual limit is exceeded. Often, there is confusion about who pays the tax. It may seem counterintuitive, but the giver is responsible for paying any applicable gift tax, even though they are the ones giving the wealth away. This can be good news for the recipient, but there can be unintended tax consequences, such as long-term capital gains tax on a security that the gift receiver can be left holding the bag for. Hence, it is important to consult with a Tax or Estate planning professional before bestowing a large gift of securities like stocks, or other non-monetary property.

Annual Exclusion Limit vs. Lifetime Exemption

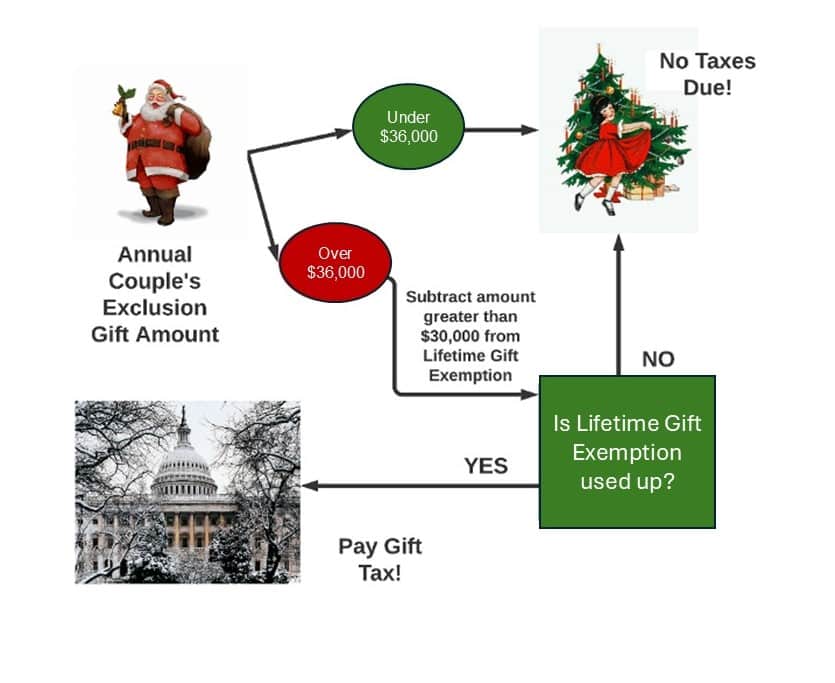

What constitutes a large gift? For this article we will define it as a gift (cash, property, stocks, cars, jewelry, etc.) that draws the attention of the IRS. There are two terms that are important to know, the Annual Exclusion Limit and the Lifetime Exemption. The Annual Exclusion Limit is currently $18,000 per person, per year. This means that you can give as many people as you want gifts valued at $18K or less every year with no tax consequences. For married couples, this amount doubles to $36,000. This amount is outside of certain other giving categories, such as paying for certain medical and educational expenses, or charitable contributions.

What happens if your gift goes over the limit?

It is important to understand which forms of giving are subject to gift taxes and which are not. What happens if you go over the limit? Are gift taxes automatically due?

The good news is if you go over the Annual Exclusion limit, you still have the Lifetime Exemption ($13.61 million/person or $27.22 million/couple in 2024). Think of the Lifetime Exemption as a bucket that catches any overflow from the Annual Exclusion Limit. For example, let’s say you and your spouse give your son your impeccably restored 1968 Chevy Camaro, now valued at $80,000. Would you have to pay gift taxes on the $44,000 excess (the difference over the $36,000 married Annual Exclusion Limit)? No, because the excess can be deducted from your Lifetime Exemption. As long as the total gifts you give over your lifetime don’t exceed the $13.61 million (or $27.22 million for couples), no gift taxes would be due.

Think of the Lifetime Exemption as a bucket

that catches any overflow from the Annual Exclusion Limit.

The answer is no, but you would have to file an IRS form 709 that you would report this gift on. What would then happen is this amount would be subtracted from your Lifetime Exclusion in 2024. If you have a Jay Leno-caliber collection of cars and give over $27.22 million worth of cars and other property away, you and your spouse could finally be subject to the gift tax (see the figure above) for a graphic example of how this works). The gift tax is progressive, and ranges between 18 and 40 percent. If you reach this point, you’ve been exceptionally generous!

For questions about what gifts can be given annually without triggering IRS involvement, we are always happy to help. To schedule a complimentary call or meeting please visit us at www.f5fp.com.

Would You Like More Support?

- Do you have a well-defined Investment Policy Strategy that is used to drive your investments in support of a comprehensive financial plan?

- If not, would you like to partner with someone who is used to helping people get through these struggles and (then, with confidence) implement portfolio strategies in a systematic manner while focusing on your desired outcomes?

If so, feel free to send us an email or give us a call. We’d love to have the opportunity to help you find a bit more peace of mind when it comes to investing.

Photo credit: (top to bottom): Rawpixel, Rawpixel, F5 Financial (with Rawpixel photos inside graphic), and Rawpixel

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving