You Need To Focus on What You Can Control

By: Curt Stowers

Today we focus on what is in your control when it comes to investing!

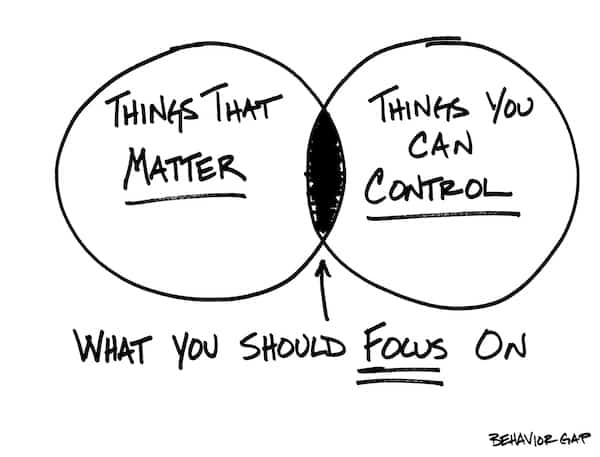

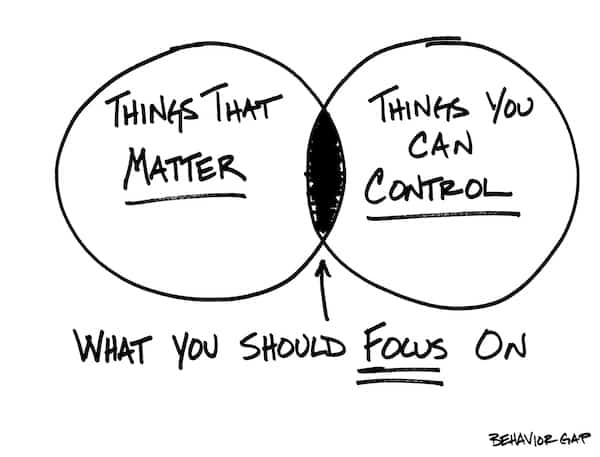

Back in 2014, Carl Richards at Behavior Gap was gracious enough to share twelve of his best graphics with anyone who wanted them for absolutely no charge. His hope was that financial advisors could take these images and use them to convey the importance of using a disciplined process to reach your investing goals.

I've taken Carl's images and used them to explain how to systematically approach investing based on these twelve pictures. Hopefully, they will help at least one individual take the necessary steps to reach their personal, professional, and financial goals.

Without further ado, picture number two . . .

You Need to Focus on What You Can Control.

This is one of my favorite images from Richards. The message is clear:

- You should ONLY be focusing on the things that MATTER and that you can CONTROL.

There is a long list of things in EITHER of the categories. However, the list of things in BOTH of the categories is actually quite small.

When it comes to investing, I would list the following 6 items as things that matter that you can control:

- The amount of risk you take via your investment in stocks versus bonds

- The diversification of your portfolio via an asset allocation strategy

- Your adherence to a defined strategy via the development and implementation of an Investment Policy Statement

- The placement of your investments in tax-advantaged accounts

- The fees that you pay your advisor

- The fees that you pay the mutual funds you invest in

With the above in mind, I'd ask yourself the following question the next time you start to worry:

- Is what I'm thinking of important AND something that I can control?

Once you recognize that your effort is best served on only the intersection of these two dimensions, you will sleep a lot better at night. Next week we’ll take on the topic of simplicity . . .

----------------

Each month, for the next twelve months, I will be publishing another picture to help people understand the investment process.

If you have any questions about the topics covered in this post, feel free to reach out to me at any point in time. At F5 Financial, we enjoy working with entrepreneurs, corporate executives, and families to define their goals and make sure they have plans in place to execute and achieve those goals.

Investing in Twelve Pictures - Previous Posts:

Would You Like More Support?

- Do you have a well-defined Investment Policy Strategy that is used to drive your investments in support of a comprehensive financial plan?

- If not, would you like to partner with someone who is used to helping people get through these struggles and (then, with confidence) implement portfolio strategies in a systematic manner while focusing on your desired outcomes?

If so, feel free to send us an email or give us a call. We’d love to have the opportunity to help you find a bit more peace of mind when it comes to investing.

Illustration credit: Carl Richards (Behavior Gap)

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving