It’s NOT a Plan—It’s a Process! (Investing in 12 Pictures)

By: Curt Stowers

Investing done right is part of a comprehensive, iterative, financial planning process. Read on to learn more!

Back in 2014, Carl Richards at Behavior Gap was gracious enough to share twelve of his best graphics with anyone who wanted them for absolutely no charge. His hope was that financial advisors could take these images and use them to convey the importance of using a disciplined process to reach your investing goals.

I've taken Carl's images and used them to explain how to systematically approach investing based on these twelve pictures. Hopefully, they will help at least one individual take the necessary steps to reach their personal, professional, and financial goals.

Without further ado, picture number four . . .

It Is NOT a Plan—it Is a Process!

A lot of people think of investing as a “one and done” proposition. Nothing could be further from the truth!

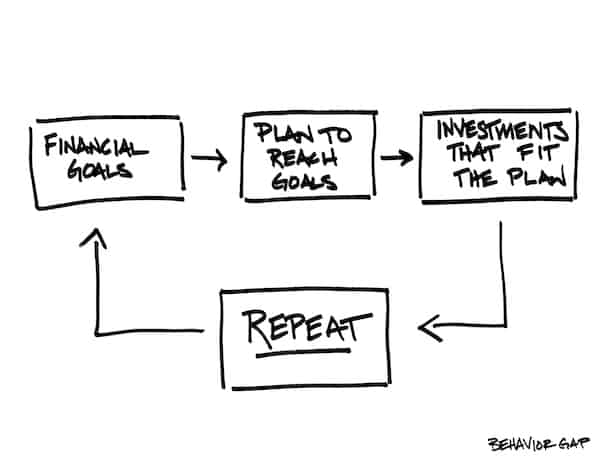

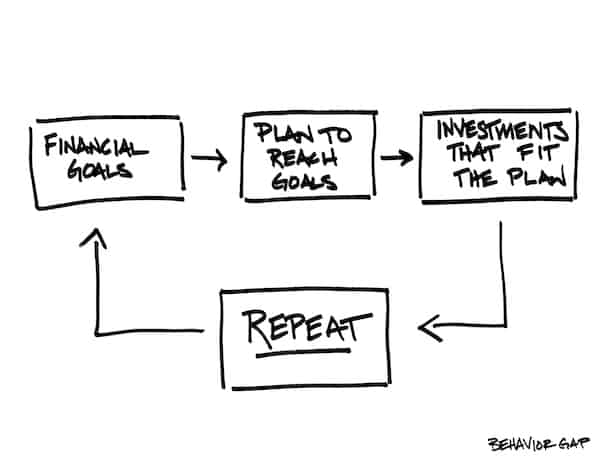

Investing taken in isolation or by itself is of little value. My guess is that sentence shocked more than a few folks! Investing done right is not even part of a financial plan. Investing done right is part of a comprehensive, iterative, financial planning process.

Investing done right is:

- Comprehensive – Dealing with all of the issues

- Iterative – Taking place repeatedly

- Process – A systematical, well-defined method

Financial planning done right involves these three key elements.

Before investing, two steps:

With the above in mind, decisions on investments can only be made after two important steps have been taken:

- Identifying your goals

- Establishing your plan to reach your goals

While these two steps seem obvious, too many individuals bypass them and turn their attention to picking the “magic” investments. Investments are simply tools that help you to reach your financial goals.

Furthermore, over time our situations continually change. That results in changes to our goals, changes to the plan, and—not surprisingly—changes to our investments.

Before you head to Morningstar or Yahoo Finance, you need first to define your goals and establish your financial plan. Only then should you turn your attention to selecting investments.

Each month, for the next twelve months, I will be publishing another picture to help people understand the investment process.

If you have any questions about the topics covered in this post, feel free to reach out to me at any point in time. At F5 Financial, we enjoy working with entrepreneurs, corporate executives, and families to define their goals and make sure they have plans in place to execute and achieve those goals.

Investing in Twelve Pictures - Previous Posts:

- Picture 1 - You Have to Start with a Goal

- Picture 2 - You Need to Focus on What You Can Control

- Picture 3 - The Best Solutions Are Simple

Would You Like More Support?

- Do you have a well-defined Investment Policy Strategy that is used to drive your investments in support of a comprehensive financial plan?

- If not, would you like to partner with someone who is used to helping people get through these struggles and (then, with confidence) implement portfolio strategies in a systematic manner while focusing on your desired outcomes?

If so, feel free to send us an email or give us a call. We’d love to have the opportunity to help you find a bit more peace of mind when it comes to investing.

Illustration credit: Carl Richards (Behavior Gap)

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving