Investing and Bad Behavior…

A few weeks back I wrote a post about the ability of investors to out think themselves. Alas, as the famous quote from George Santayana states:

- “Those who cannot remember the past are condemned to repeat it.”

And just as if I was psychic, it happens again! You can read all about the highlights of exactly this phenomenon in this article that summarizes the 2014 Dalbar study.

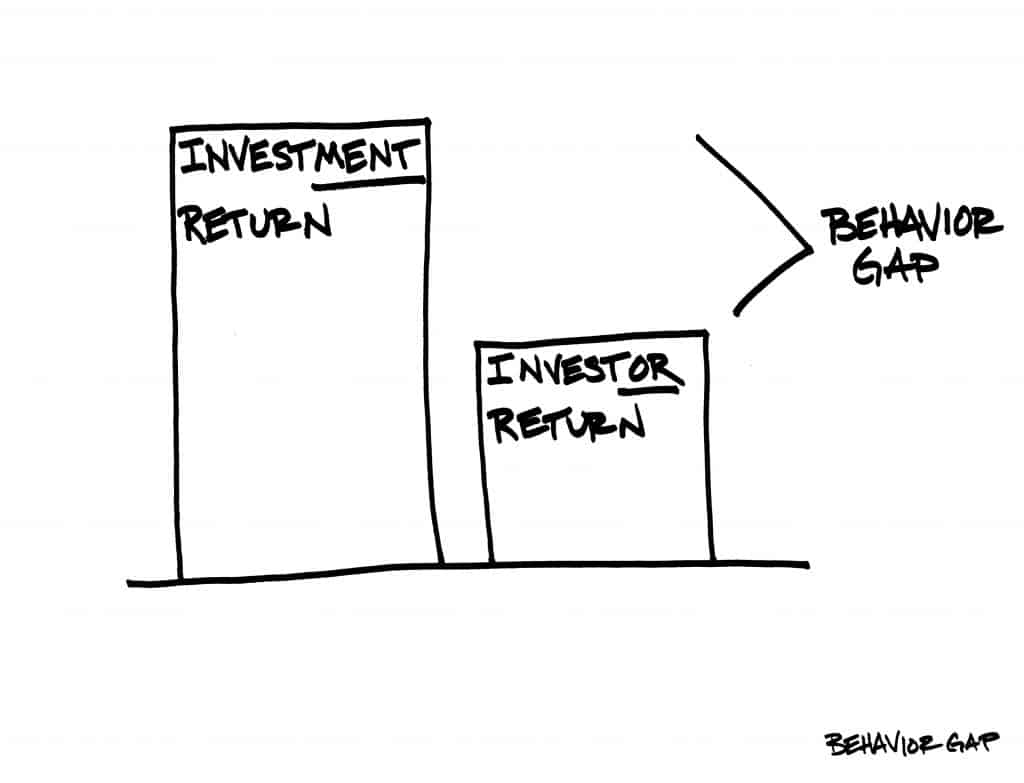

For those that prefer pictures, here’s the simple summary:

In 2014, the S&P returned 13.7% while the average equity investor brought home only 5.5%. Now mind you, the 13.7% was not a “good” return as the smart investor would have been in a portfolio with multiple asset classes and only a foolish investor would count on the S&P 500 providing adequate diversity (see the 2000-2010 period if you have any doubts on this). However, it is still the case that the average INVESTOR return was lower than the average INVESTMENT return.

But wait you say, that is stocks. The bonds MUST have done better. WRONG! The Barlay’s Aggregate Bond Index returned 6.0% while the average fixed income investor only saw 1.2%

Folks, here’s the reality:

- Unless you have a strategy — preferably with a written investment policy statement (IPS) — you’re likely to fall victim to your emotions and zig when you should zag!

I’m confident in two things:

- First, I could probably change the numbers on this post and re-post each year and deliver the same message a vast majority of the time. Yes, some years investors will do better. However, history shows that most the time emotions win out and investors lose.

- Second, there will be a year when the market tanks and the wizards that proclaimed doom and gloom a priori will thump their chests and have all of us look at how smart they are by being out of the market. They’ll be right for that year. But they’ll likely be very wrong the following year.

Investing is not about picking winners. It’s about avoiding losers via a stable, well-diversified, IPS that captures the various asset classes and doesn’t try and outsmart the market. It’s not sexy. And it’s not exciting. It is boring and effective.

Take some time and review your investments against your IPS. Don’t have an IPS? Then you can likely look forward to the Behavior Gap that Carl Richards illustrated above / writes about often.

Or you can take the time to develop an IPS on your own or reach out to a professional that can help you do so. Just remember…

- “Those who cannot remember the past are condemned to repeat it.”

And don’t make me remind you of the definition of insanity!

Some other posts that you might like: