Why CNBC Is Bad For Your Investments

Consider the following headlines:

- Senate Confirms Yellen for Fed

- Industrial Production Notches Strongest Yearly Gain Since 2010

- US Stocks Slide as Jitters Persist

- Corporate Profits Hit New High as GDP Revised Up

- Bond Investors Still Waiting for Yields to Rise

- Private Employment Hits a New High, but Government Hiring Lags

- Housing Slow to Take Off in Spring

- US Considers Lifting Crude Oil Export Ban

- Bond Rally Takes Yields to Yearly Lows

- Fed Officials Signal that Rates to Stay Low for Long Time

- Home Builder Optimism Hits Six-Month High

- Consumer Rebound Chugs Ahead

- Unemployment Claims Hit Eight-Year Low

- US, EU Widen Sanctions on Russia

- US-Led Airstrikes Aid Syrian Kurds, Target Islamic State Oil Assets

- Gold Prices Fall to Four Year Low

- Mortgage Rates Tumble

- Fed Closes Chapter on Easy Money

- Soft New-Home Sales Weigh on Recovery

- Oil Prices Tumble to Five Year Lows

- US Restores Cuba Ties in Historic Deal

- US Economy Posts Strongest Growth in More Than a Decade

- Dollar Ends Best Year In More than a Decade

I don’t know about you, but for me the above headlines sound alarming AND sound as if I need to be doing something to respond! After of all these are BIG NEWS!

And that’s exactly the point – they’re “BIG NEWS” in the sense that the BIG NEWS guys like to make up headlines that cause us to perk up and pay attention. Your attention equals more viewership. More viewership equals more ratings. More ratings equals more advertisers. More advertisers equals more dollars in their pocket.

While I respect and applaud their desire to generate more dollars – I’m an unapologetic capitalist! – I don’t have any interest in dollars in their pockets. I have interest in dollars in MY pocket.

That’s why as an investor you need to have the discipline to IGNORE the news and stay the course with a well-defined, appropriate Investment Policy Statement (IPS). The purpose of an IPS is to describe how you will invest and for what purpose you will invest. And in almost all cases, the headlines that you read are NOT going to have one single bit of effect on your IPS

So what’s the take away? Two things:

- The media is out to make money for themselves and not you

- As an investor you need to ignore the news and pay attention to your IPS

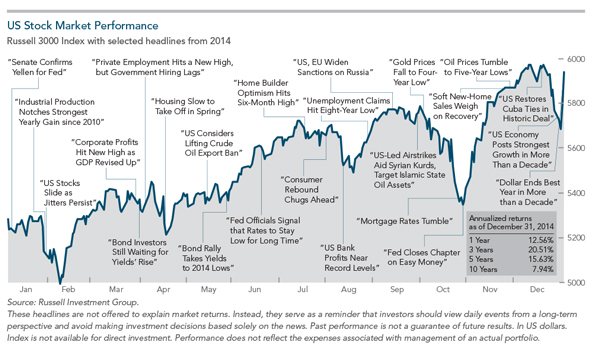

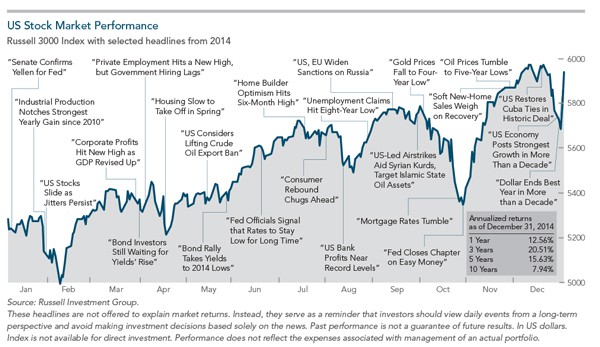

Skeptical? Well, that’s why they say a picture is worth a thousand words. Here’s an overlay of the Russell 3000 index (this index represents the broad US stock market) for 2014 with the headlines from above shown on the dates they occurred.

As you read each headline, consider what you might have done with the information if you were inclined to take an action with you portfolio. Then look at what happened post-news.

- How would the action you contemplated have turned out for you?

My guess is that you would have made the wrong call a lot of the time.

While it is tempting to take an action to give ourselves the sense we are doing something, investing is often about doing NOTHING versus doing something. When we do something it needs to be aligned with our goals and objectives – which is EXACTLY what our IPS describes!

The moral of the story

- CNBC is bad for your investments

And I wouldn’t be surprised at all if they took objection to the above. After all, it would probably make a good story and get ‘em a few more dollars! That’s why I respect the heck out of them as business people!

Hopefully you have your own personal IPS developed and implemented. If you do not, head over to the NAPFA (National Association of Personal Financial Advisors) web site and find a fee-only financial planner that can help you to develop your IPS.

Some other posts that you might like: