Finance

KonMari – Learning Financial Planning from Marie Kondo!

There is some brilliance in Marie Kondo’s method, and her approach can be applied to financial planning. Read on to find out how to “tidy up” your financial life.

Read MoreThe Value Of Time

Time is a SCARCE resource and money is an ABUNDANT resource

Read MoreCommodity Investing – Why I Suggest Avoiding

A great rule to follow is this: if you don’t understand something, you should not get involved. For many, commodity investing is one such area. Read on to learn why I take this position.

Read MoreA Private Letter from the IRS – Leveraging the 401(k) Plan to Reduce Student Loan Debt

Did you know that you can get a “private letter” from the IRS that has good news? Read on to find out a bit more about “Private Letter Rulings” (PLRs) from the IRS—plus a surprising way one company is helping employees pay off their student loan debt!

Read MoreSix Sigma and Financial Planning

Today I’m going to show you how you can apply the basics of Six Sigma to build your personal financial plan

Read MoreIs Your Financial Advisor In Their Right Mind?

The next time you sit down with your advisor take a look at where the focus is. Is it on the minutia of the facts and data?

Read MoreBruce Lee – Expert Financial Planner

Don’t be the fool that practices 10,000 different investment strategies. Develop a solid IPS and stick with it through thick and thin

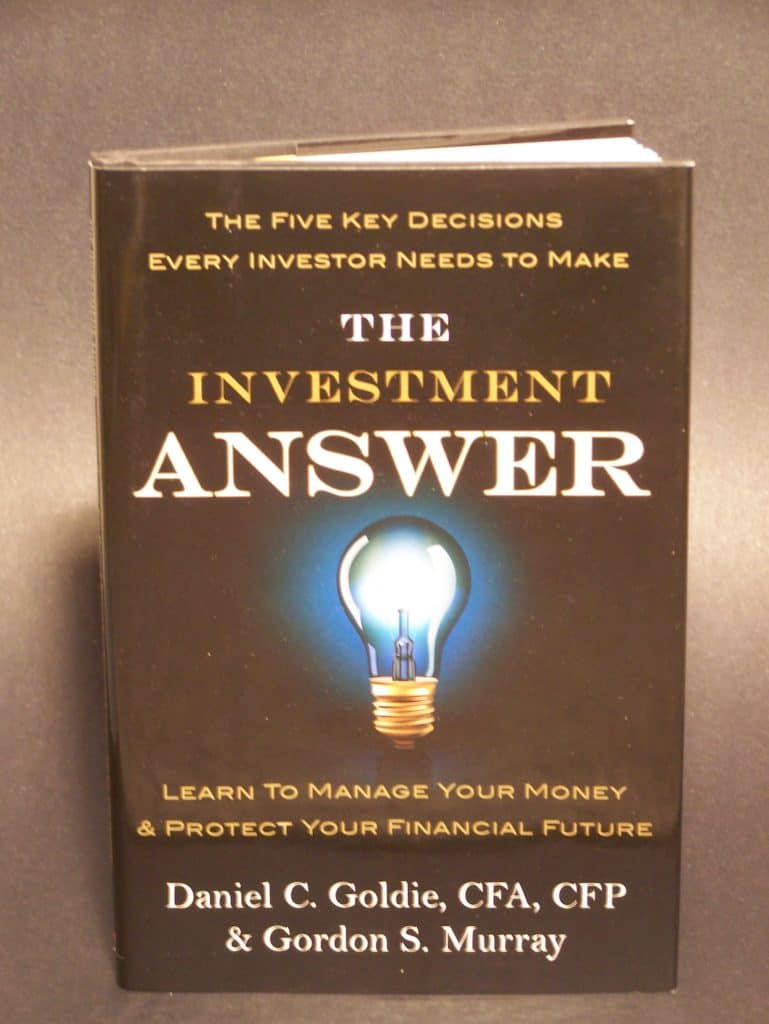

Read MoreBook Summary – The Investment Answer

Gordy and Murray walks individuals through the five key decisions that individuals need to make in order to be successful as investors. See how you’re doing…

Read MoreBecoming Comfortable With Money

It has always amazed me how uncomfortable some people are in discussing the topic of money. My guess is that is because of how they were – or were not – exposed to the topic. Growing up I saw my Dad and Mom work hard.

Read MoreMonday Morning Motivation – Humility

Would you be a better person if you spent time focusing on the key aspects/dimensions of humility?

Read More