London, Brussels or Paris – Which One is Best? (How to Invest in Developed Markets)

By: Curt Stowers

Pick a Winner—If you Can

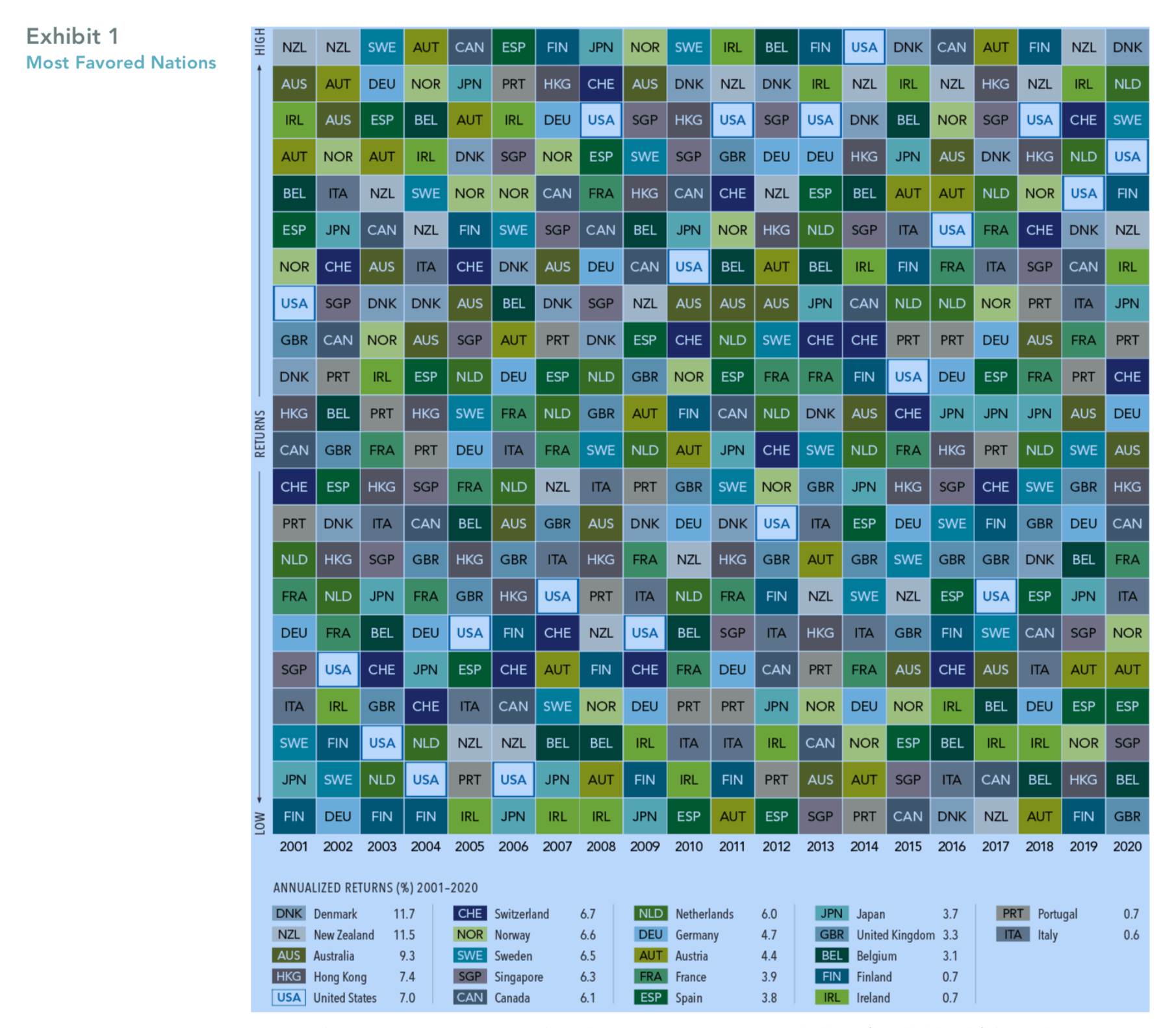

Developed markets? They say a picture is worth a thousand words, so let’s start with this one:

This chart tracks the top-performing developed markets over the time frame of 2001 to 2020. If you can find a pattern in this data, then you are a better person than I am!

So What Do You Do? (How should I invest in developed markets?)

The answer is simple—in my opinion. I believe that rather than trying to “pick the winner” you buy ALL the developed markets vis-à-vis a low cost, diversified mutual fund. When you take this approach, you avoid the extremes—up or down.

Unfortunately, too many folks are swayed by the belief that they are a permanent resident of the Lake Wobegone investment club. They KNOW that they can and will beat the market (sarcasm intended). So, they target the best market.

Many—if not most—who follow this belief set pick the best performer from LAST year as the likely best performer for THIS year. I’ll spare you the lecture. This simply doesn’t work, and the picture shows this clearly.

So There’s Nothing I can Do?

That’s not what I’m saying. You can choose how much to be invested internationally and which strategy you want to choose in pursuing international investments. You can also choose the particular tool that you want to use (i.e., a specific fund).

In addition, if you want to stake out a position on which is the best of the developed markets, stake it out on something where there is some—like who’s got the best food!!! And while some may argue with me, I’d put Brussels ahead of Paris and both ahead of London!

You can read more about this topic in the attached article:

Would You Like More Support?

- Do you have a well-defined Investment Policy Strategy that is used to drive your investments in support of a comprehensive financial plan?

- If not, would you like to partner with someone who is used to helping people get through these struggles and (then, with confidence) implement portfolio strategies in a systematic manner while focusing on your desired outcomes?

If so, feel free to send us an email or give us a call. We’d love to have the opportunity to help you find a bit more peace of mind when it comes to investing.

Photo credit: Leonard Cotte on unsplash.com

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving