Data check: Do downturns lead to down years?

By: Curt Stowers

No doubt the last two months in the stock market has NOT been for the timid! However, the last two months were NOT unexpected. I regularly state with a high degree of confidence that you need to EXPECT a 50% drop in the value of your equity holdings at ANY time. Today we discuss downturns.

Unexpected, unanticipated events (and the downturns that follow)

While I cannot “guarantee” such a painful event, I can look at the past and see that unexpected, unanticipated events have historically shown up and caused losses of this magnitude. I fully expected this drop, BUT I had NO IDEA when it would occur—nor, do I believe, did anyone else.

It's NOT about the drop—but about investor behavior

However, the issue is NOT with the drop. The issue is with the INVESTOR BEHAVIOR after the drop. Investors that “jump out” after major down movements normally do not “jump in” at the bottom and capture the subsequent market recoveries. We know this is the case, as DALBAR annually shows that there is a large delta between INVESTMENT and INVESTOR returns.

Do downturns lead to down years?

With all of the above as a precursor, the question I wanted to take on this week is this: Do downturns lead to down years?

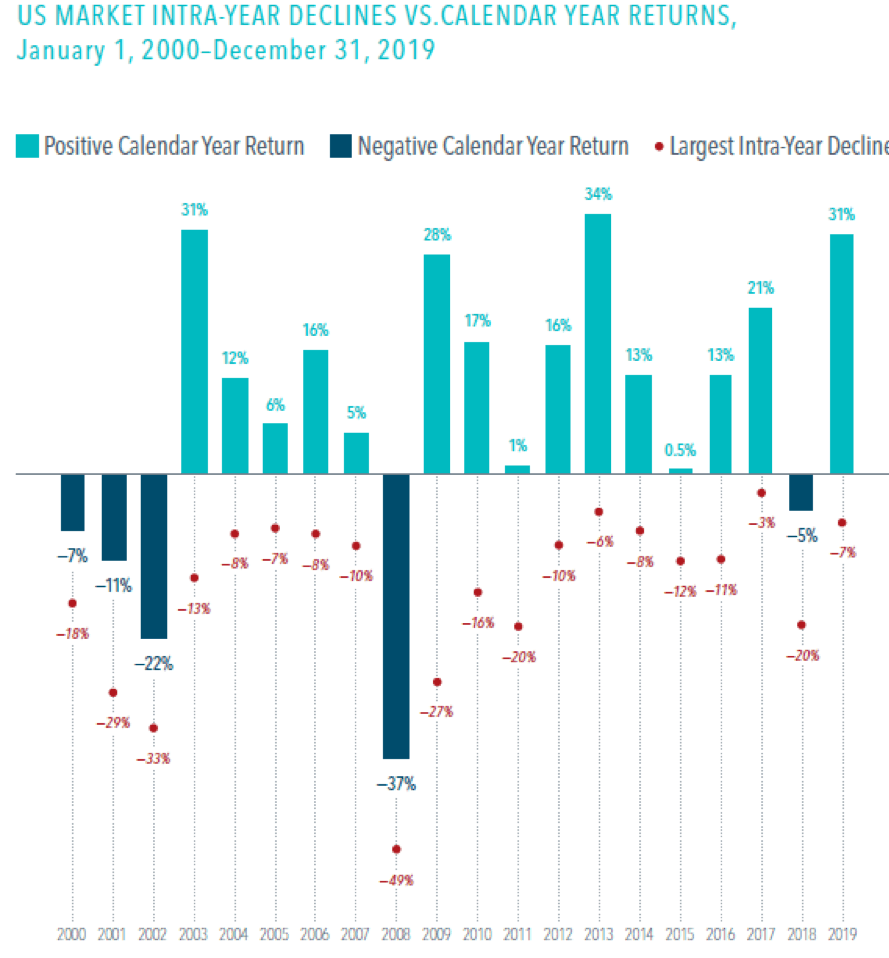

Let’s look at the period from 2000 – 2019:

A few things jump out at me:

- We have seen a decline of at least of 20% within the year 6 out of the 20 years (see the red numbers for 2002, 2008, etc.). That means that 30% of the time we have seen annual declines of 20%.

- Overall, a downturn during the year has NOT resulted in a negative performance for the year, as fifteen of the twenty years have shown positive returns for the full year.

- When we have gotten intra-year declines in excess of 20%, the year returns have not been favorable, as four of the six years with intra-year declines have had negative full-year returns (-11%, -22%, -37%, -20%).

My take-away from the above is as follows:

- Intra-year declines are common.

- Intra-year declines—IN GENERAL—do not appear to lead to full year declines

- Yes, major (greater than 20%) intra-year declines appear to have a strong correlation to full-year declines.

- However, major (greater than 20%) intra-year declines appear to have minimal effect on long-term returns, as it appears the market recovers quickly.

There are NOT guarantees in investing. However, worrying that the short-term decline we have seen is going to lead to long-term declines does not seem to be consistent with the historical data. For me, the most important thing is to have a solid Investment Policy Statement in place that is being rigorously implemented.

You can see more information on this topic at this article.

Would You Like More Support?

- Do you have a well-defined Investment Policy Strategy that is used to drive your investments in support of a comprehensive financial plan?

- If not, would you like to partner with someone who is used to helping people get through these struggles and (then, with confidence) implement portfolio strategies in a systematic manner while focusing on your desired outcomes?

If so, feel free to send us an email or give us a call. We’d love to have the opportunity to help you find a bit more peace of mind when it comes to investing.

Photo credit: Rawpixel.com

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving