Are You Ready to Take the Pill?

By: Curt Stowers

Failing to plan is planning to fail. Are you ready and willing to take your medicine? Read on to learn the 8 steps needed to build your financial plan.

The Challenge

All too many people struggle with the question “Will I ever be able to retire?” To me this is perplexing.

That’s because my brain thinks in terms of numbers and the “can I retire” question boils down to a question of income, expenses, and rates of return.

Unfortunately, many never think of it in these terms. Instead, they look at the question as an unsolvable mystery of life.

Avoidance ain’t a good thing

I actually believe that a vast majority of people are fully capable of answering the “will I be able to retire” question. However, they choose to avoid answering because it might mean they have to impose discipline in their lives. As Jim Rohn says:

- We must all suffer from one of two pains: the pain of discipline, or the pain of regret.

Discipline in your financial habits today or regret in your non-existent retirement tomorrow!

Discipline in your financial habits today

or regret in your non-existent retirement tomorrow!

So What Do You Do?

Simple. Not easy, but simple. You make the time to develop and implement a financial plan:

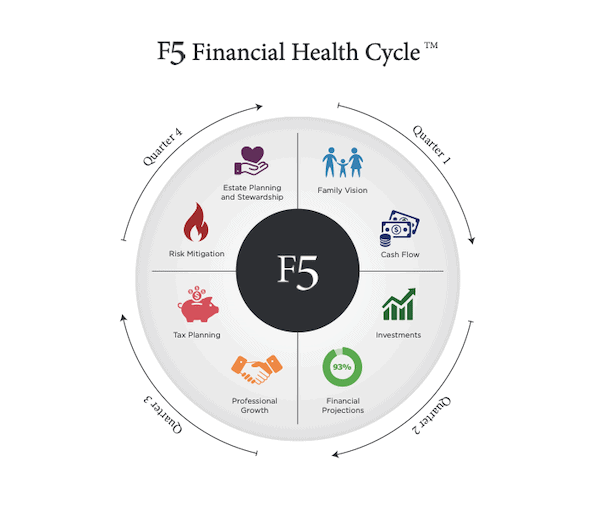

- Define your objectives.

- Analyze your current cash flow (income and expenses).

- Project what your future cash flow looks like.

- Decide on when, where, and how to invest.

- Assess your ability to improve your career/enhance your personal capital.

- Figure out how to minimize your taxes.

- Ensure that you and your family are protected.

- Plan for the eventuality that you’ll leave this Earth.

We wrap these eight steps up into what we call “The Financial Health Cycle”:

While it is certainly not the only approach to this problem, it’s a solid one that we have found to prove very effective.

So Are You Ready?

Taking medicine normally isn’t a fun thing. However, ignoring the signals that you have a problem and leaving it untreated rarely goes well.

Step up to the plate and develop and implement a financial plan for your family. You’ll be glad you did.

Would You Like More Support?

- Do you have a well-defined Investment Policy Strategy that is used to drive your investments in support of a comprehensive financial plan?

- If not, would you like to partner with someone who is used to helping people get through these struggles and (then, with confidence) implement portfolio strategies in a systematic manner while focusing on your desired outcomes?

If so, feel free to send us an email or give us a call. We’d love to have the opportunity to help you find a bit more peace of mind when it comes to investing.

Photo credit: F5 Financial

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving