How To Save $990 A Year On Your Child’s Education

Sometimes we share the same information in consecutive weeks. That’s because we want to make sure folks saw it and REALLY thought about it. Last week Dylan from our team shared some great insights into how to save on taxes AND support your kid’s education. BTW, you can use this tip to contribute to ANYONE’S education. Please take a look and see if you can take advantage of the information that we shared last week.

Are you looking for more ways to save on your child’s education?

529 Plans offer GREAT long-term opportunities to pay for your children’s education. Contributions grow tax-free and are tax-free if withdrawn to pay for your kid’s college. Further, the TCJA of 2017 opens up these plans for use before college. We’re a big fan at F5 Financial of leveraging these tools. But, there is another opportunity available in some states – we’ll talk about Illinois in this article. However, many other states have similar opportunities.

Standard disclaimer here: If we’re not your advisor, don’t take our word for what follows- reach out to your advisor. Conversely, if your advisor can’t help or doesn’t “get it” we’d be happy to talk to you about becoming your advisor!

What if we told you that you can save nearly $1,000 a year on your kid's college?

$990 to be exact, in the state of Illinois (Although we will be using Illinois as an example many states offer similar state income tax deductions). You can pay for your kid's college expenses through a 529 Plan. This is an example of a pure tax arbitrage you can use for expenses you would spend anyway. Here’s how it works:

- Imagine you're going to pay for your kid's college out of pocket by writing a check to your child’s college. By instead writing a check to the 529 Plan and then using the 529 to pay for the college expenses you can save nearly $1,000. To take advantage of it you need to set up a 529 account for your kids, if they don’t already have one.

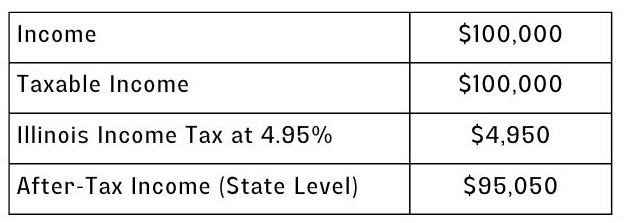

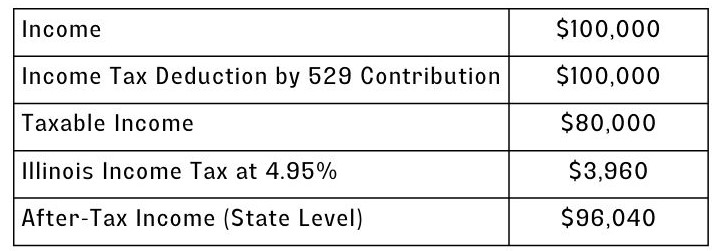

- In Illinois for example, a couple that files jointly can deduct $20,000 for contributions from their income on the state level. Saving $990 on the 4.95% state income tax in Illinois. Here’s a visual:

Without a deduction:

With a deduction:

These two scenarios have the same amount of income and have the same amount paid to the college. Still, one of them leads to a savings of $990 and when you do this over multiple years, with multiple kids, you save a lot of money on your tax liability.

Even if you currently don’t have a 529 Plan for your student you can make one today and take advantage of the tax law and deductions as soon as today. This one specifically deals with Schedule M of IL Tax Form 1040.

When dealing with taxes you have to look for things you were going to spend money on anyway to see if it could be applicable to be used as a tax deduction. The government writes tax laws to save you money and encourage you to do things, spend money, and save in the ways they would like you to do. And since the government encourages education there are many advantages to a 529 Plan.

Explore State-By-State 529 Plan Benefits

As I mentioned earlier, while this article explains the Illinois Tax Code there are similar deductions for each state with a state income tax. The link below provides a resource to explore state-by-state 529 Plan benefits:

Here is a resource for state-by-state deductions and advantages.

Hopefully, you can find a way to leverage the ideas shared above to save a little bit on taxes for your family.

Would You Like More Support?

-

-

- Do you have a well-defined Investment Policy Strategy that is used to drive your investments in support of a comprehensive financial plan?

-

-

-

- If not, would you like to partner with someone who is used to helping people get through these struggles and (then, with confidence) implement portfolio strategies in a systematic manner while focusing on your desired outcomes?

-

If so, feel free to send us an email or give us a call. We’d love to have the opportunity to help you find a bit more peace of mind when it comes to investing.

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving