Is Bigger Better? Looking at the Current Market Giants

By: Curt Stowers

The Current Leaders (Market Giants)

Recently the FAANG (Facebook, Amazon, Apple, Netflix, and Google) have gotten a ton of attention and caused many to suggest that things are different in the stock market than they have ever been. But is this true? Let’s take a look:

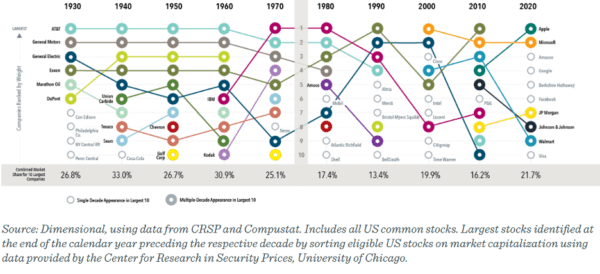

The above figure represents the market capitalization of the ten largest stocks over time. A few things jump out at me:

- The range for the market cap of the largest ten companies has gone from 13.4% to 33.0% over the time frame from 1930 to 2020

- This range has not been constantly increasing or constantly decreasing over time. It has been, from what I can see, random.

- The biggest companies have “come and gone” over time.

Of all three of the above observations, it’s the last one that is the least intuitive to me. I can’t imagine a future without Facebook, Apple, Amazon, Netflix and Google occupying the top spots in our world and in the stock market. However, I suspect that, if I were back in 1930, I would have said the same thing about AT&T, GM, GE, Exxon, Marathon, and DuPont.

Who were the market giants in 2000?

Or if I think back to 2000—which I remember—I would have been very confident that Microsoft, GE, Cisco, Walmart, and Exxon would all still be “the leaders” in 2020. However, things have changed massively, and it has hurt some of the big five from 2000. Walmart is still big, but Amazon has definitely taken market share. In 2000, I couldn’t even conceive of Amazon!

Microsoft’s still a player, but open source code and SAAS is presenting it with challenges. Think about what happened to IBM. Cisco faded as competitors emerged. Exxon fell victim to accidents and the volatility of oil prices. Furthermore, the emphasis on environmental consciousness is creating headwinds for them going forward in time.

Should you invest in FAANG stocks?

Am I recommending AGAINST investing in any of the FAANG stocks? Nope. Am I recommending FOR investing in any of the FAANG stocks? Nope. I’m just making two points:

- There have always been market leaders who appeared so entrenched that their position at the top would go on forever.

- Things change, and the behemoths are displaced.

Investing is about the long term

From an investment strategy standpoint, this topic is also interesting. Some have argued as late that the small and value premiums are artifacts of the past. They could be right. However, for now I’m going to wait and see what the data shows over the next decade or so. Investing is NOT about the short term. It’s about the long term.

You can grab a link to a more detailed discussion on this topic at this link.

Would You Like More Support?

- Do you have a well-defined Investment Policy Strategy that is used to drive your investments in support of a comprehensive financial plan?

- If not, would you like to partner with someone who is used to helping people get through these struggles and (then, with confidence) implement portfolio strategies in a systematic manner while focusing on your desired outcomes?

If so, feel free to send us an email or give us a call. We’d love to have the opportunity to help you find a bit more peace of mind when it comes to investing.

Photo credit: rawpixel.com

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving