Posts Tagged ‘f5 financial planning’

Financial Freedom Tips (VIDEO) – 2 Tips for Successful Goal Tracking

You’ve put effort and care into creating your goals. Now, In this 3-minute video, we’ll share two tips for keeping those goals on track. HINT: It’s all about 2 goal-supporting habits that will help keep you accountable.

Read MoreMonday Morning Motivation – Acknowledgment

Have you come to understand the power of acknowledgement?

Read MoreMonday Morning Motivation – Philosophy

Is your philosophy of life focused on helping others learn, grow and live a better life?

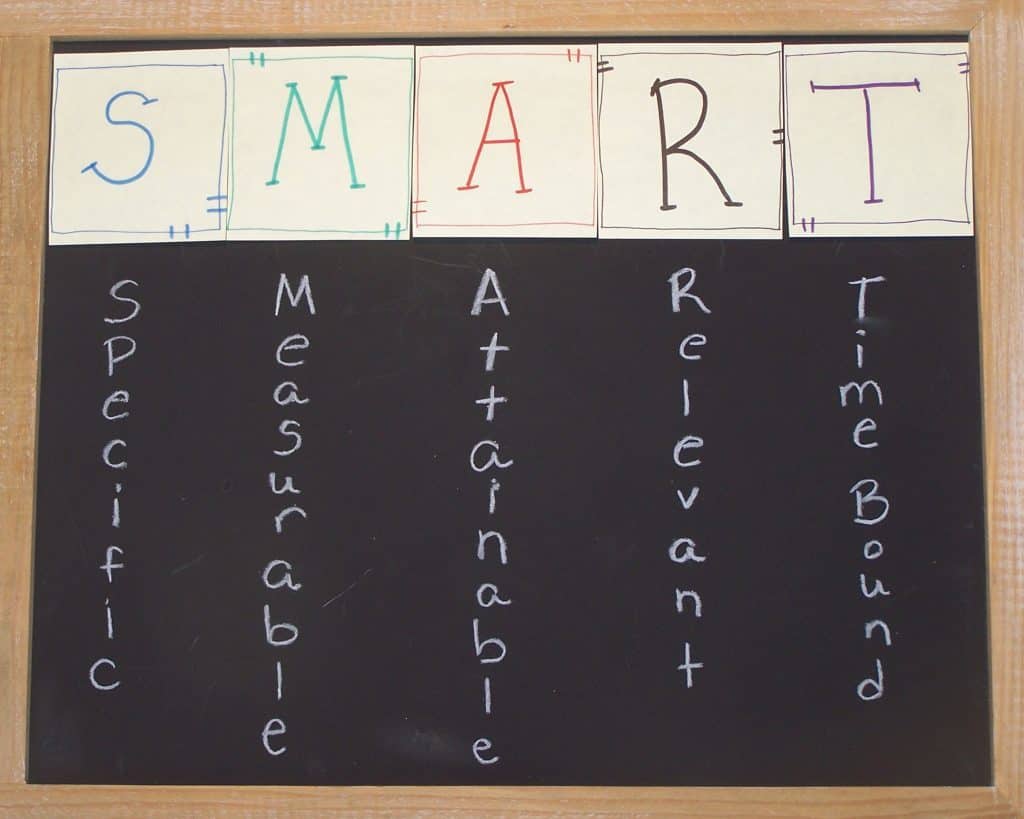

Read MoreFinancial Freedom Tips (VIDEO) – 5 Keys to Creating Smart Goals

Here we share the 5 keys to creating S.M.A.R.T. goals. When your goals are specific, measurable, achievable, relevant, and time-bound, they propel you toward personal significance.

Read MoreMonday Morning Motivation – Instinct

Are you aware of where your instincts may be steering you wrong?

Read MoreSmoothing Out the Investment Road – Shock Absorbers for Your Portfolio

I grew up with a dad who sold shock absorbers for a living, so I feel qualified to comment on their use in protecting your investment portfolio. Check out this post if you would like to smooth out the ride for your investments.

Read MoreMonday Morning Motivation – Confidence

Are you able to remain both confident and humble?

Read MoreFinancial Freedom Tips (VIDEO) – 3 Steps to Accomplish Any Goal

Setting a goal is the easy part. How do you accomplish it? In this 4-minute video, we’ll cover 3 steps that will support you in accomplishing any goal—and get set on the path to personal significance.

Read MoreMonday Morning Motivation – Perspective

What’s your perspective on things?

Read MoreYour Prescription to Cure the “Down Market” Blues

The recent market correction has left many investors LITERALLY feeling ill. There’s ONLY one prescription for this sickness. Read on if you would like the cure!

Read More