Posts Tagged ‘f5 financial planning’

Is Your Financial Advisor In Their Right Mind?

The next time you sit down with your advisor take a look at where the focus is. Is it on the minutia of the facts and data?

Read MoreBruce Lee – Expert Financial Planner

Don’t be the fool that practices 10,000 different investment strategies. Develop a solid IPS and stick with it through thick and thin

Read MoreMonday Morning Motivation – Respect

Are you treating others with respect or condemnation?

Read MoreBook Summary – The Investment Answer

Gordy and Murray walks individuals through the five key decisions that individuals need to make in order to be successful as investors. See how you’re doing…

Read MoreMonday Morning Motivation – Dependence

Do you need to reconsider your perspective on dependence on others?

Read MoreBecoming Comfortable With Money

It has always amazed me how uncomfortable some people are in discussing the topic of money. My guess is that is because of how they were – or were not – exposed to the topic. Growing up I saw my Dad and Mom work hard.

Read MoreMonday Morning Motivation – Handle

Which handle are you going to grab hold of when you face your next challenge or crisis?

Read MoreFinding A Financial Advisor Even Your Mom Could Trust

You’ve come to the conclusion that you need the help of a financial advisor. Multiple friends have given you “their guys” name. You’re confused and overwhelmed. You don’t want to make the wrong choice and you’re worried that you may inadvertently hire the next Bernie Madoff. Sound familiar? That’s not surprising at all. For most…

Read MoreMonday Morning Motivation – Expectations

Are my expectations reasonable and aligned with what is most important in my life?

Read MoreWhy Emotions Cause Investors to Fail

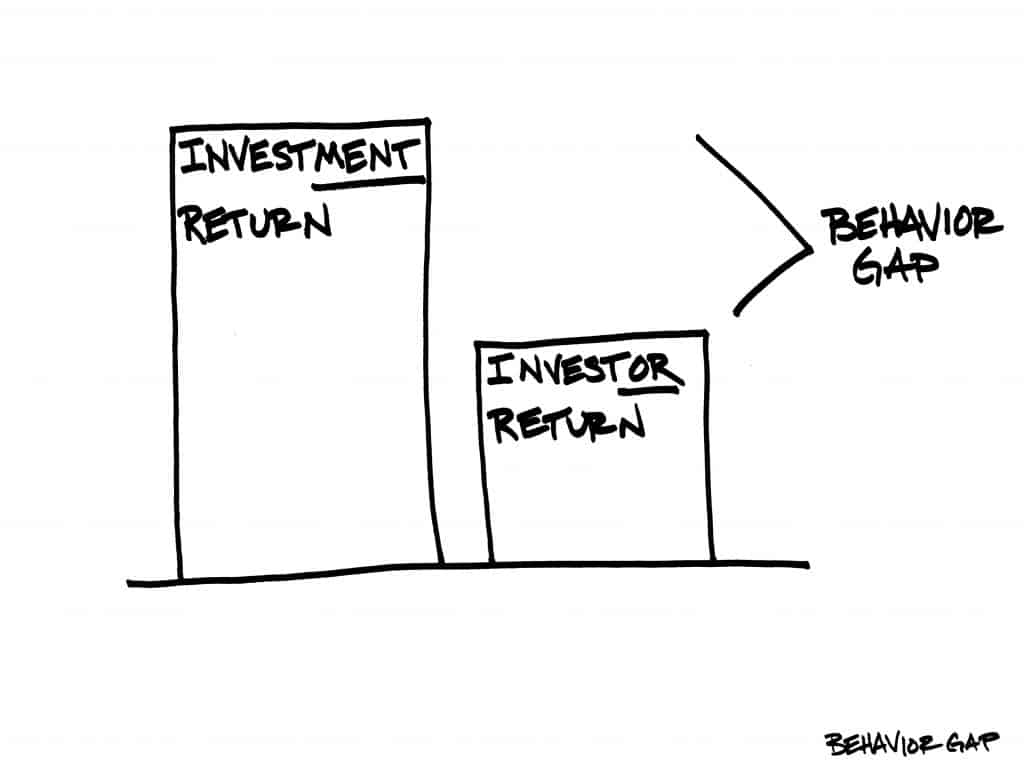

If you have spent any time doing research into investing, you quickly discover that there is a straightforward, well-proven recipe for success: Implement a solid investment strategy built around asset allocation. Make sure the strategy is well defined via an Investment Policy Statement (IPS) and have the discipline to maintain and adjust this policy over…

Read More