Posts Tagged ‘fee-only’

What the Coronavirus Relief Bill means for you

What will you receive from the Coronavirus Stimulus Package? Here’s a detailed calculator (to download), as well as a summary of the Coronavirus Relief Bill.

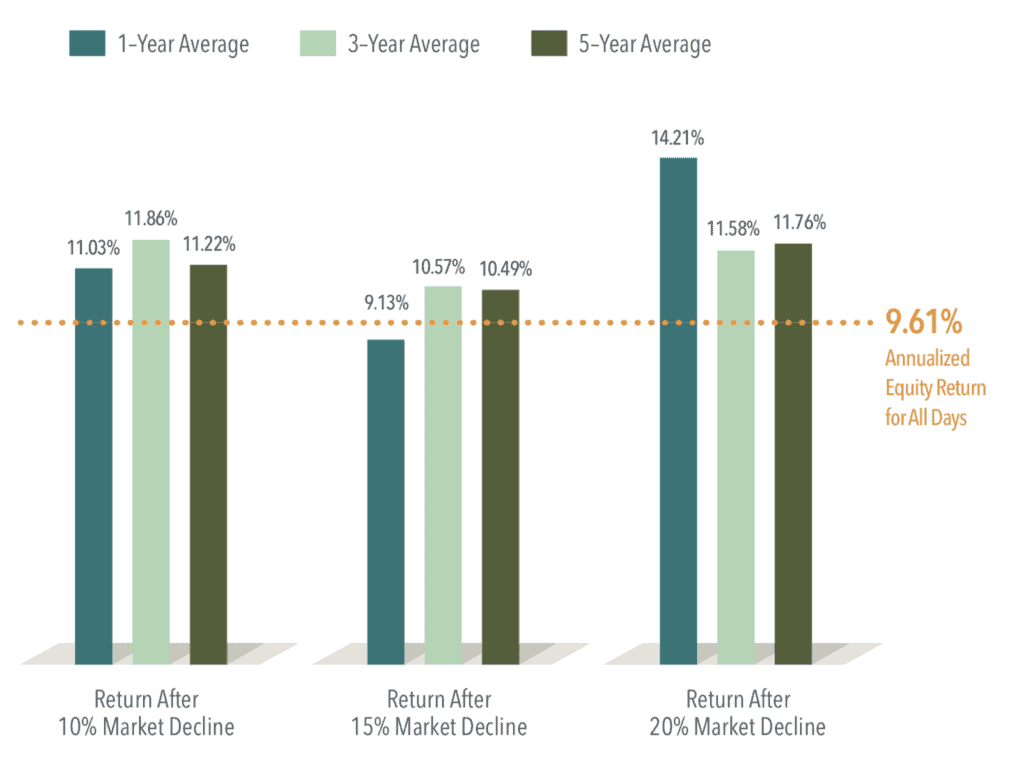

Read MoreUS Equity Returns After Sharp Downturns – a History Lesson

Sudden market downturns can be unsettling. But historically, US equity returns following sharp downturns have been positive.

Read MoreF5 Financial Team’s insights—Market Volatility

With all of the volatility in the market over the past two weeks, we wanted to take 5 minutes to share some thoughts and perspective on what we are seeing and feeling.

Read MoreDisability Insurance – What You Need to Know

Today I discuss disability insurance—do you need it? I cover the different types available (short-term and long-term), as well as steps to evaluate your risk logically.

Read MorePerspectives in the Panic

Welcome to 2020—where black swans ride rollercoasters! Read on to hear our perspective on recent market volatility and coronavirus.

Read MoreGot a Bonus? Save Half!

Today I share the best way to celebrate and enjoy the blessings of your bonus: Save half! Or as they say, “When times are good, put some hay in the barn.”

Read MorePerspectives on Dividend Investing

Should you focus on dividends when selecting equities? Read on to hear F5 Financial’s perspective.

Read MoreRetirement! Tax-Deferred vs.Tax-Free

Which accounts are better for your retirement? Today, a quick overview of tax-deferred vs. tax-free! Learn about how taxes and contributions work for each.

Read MoreQuarterly Market Review – Fourth Quarter 2019

Once per quarter, we roll up our sleeves and take a deeper dive into what’s happened in the stock market. Take a look at the attached presentation if you’d like to view the recap for Oct – December 2019. (Includes the 2019 Annual Review)

Read MoreHow to Get Goals Back on Track

What do you do when you realize you’ve lost focus? Not making progress on your goals? Here we offer some solid advice for getting those goals back on track!

Read More