Why Emotions Cause Investors to Fail

If you have spent any time doing research into investing, you quickly discover that there is a straightforward, well-proven recipe for success:

- Implement a solid investment strategy built around asset allocation. Make sure the strategy is well defined via an Investment Policy Statement (IPS) and have the discipline to maintain and adjust this policy over time.

Simple. Develop it. Write it down. Execute it.

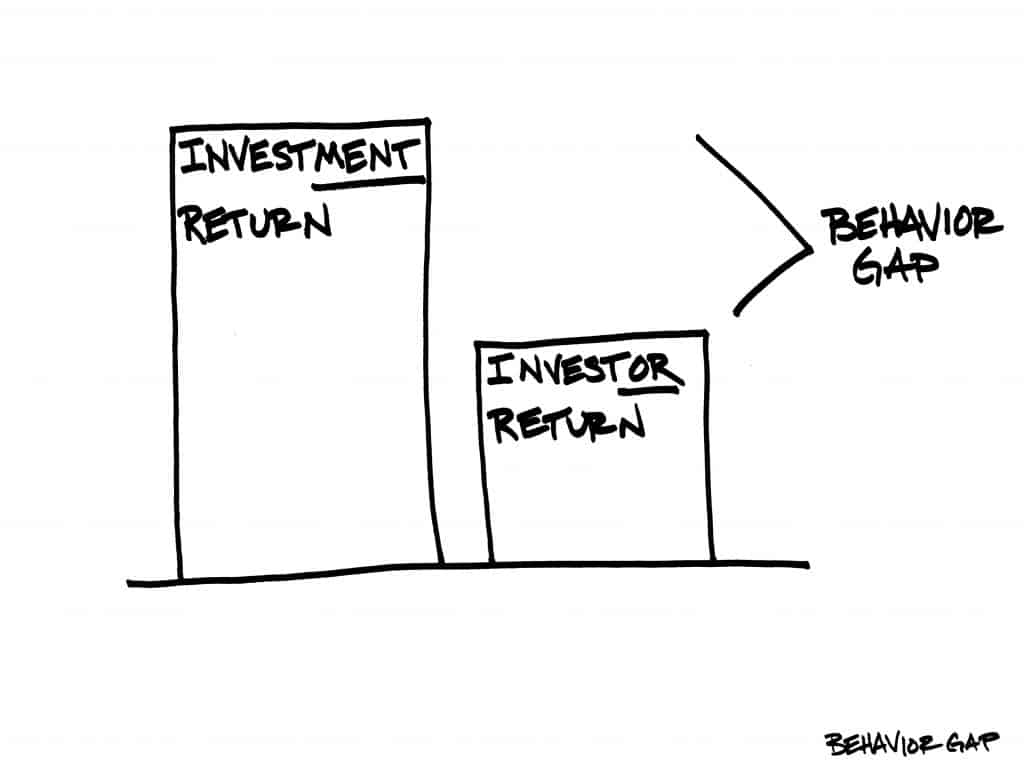

And yet year after year, the average INVESTOR return significantly underperforms the average INVESTMENT return (you can google “investor versus investment return” to see countless articles discussing this phenomenon). After reviewing all the studies, you will see that the consensus is generally that this delta in performance is in the 2 to 4% per year range. Carl Richards has termed this phenomenon the behavior gap and has captured it quite eloquently in the simple graphic which is associated with this article. However, the key question remains:

-

Why is this the case?

Welcome to what I call the “impact of emotions”.

Suppose that I walked up to you right now and gave you $5 – no strings attached. My guess is that you would be pretty happy and counting on your good fortune. You might even tell a couple of people about it throughout the remainder of the day.

Now let’s turn things around a bit. Suppose I walked up to you, removed your wallet, and took $5 out of it. My guess is you wouldn’t be a little bit mad. You would be absolutely furious! You would likely confront me and be looking for the nearest police officer to arrest me.

Now let’s look at another alternative. Suppose that I had just shown you the most heartfelt video about some poor unfortunate child. Further, I had that child enter the room with a dirty face, tattered clothing, and tussled hair. I asked you to please provide them with $5. While there’s no guarantee that you would give, most would. Further, many that would not give would FEEL (more on feelings versus emotions in a bit!) bad for not helping.

So we just went through getting $5 versus giving $5 – with the “giving” occurring in two different ways! For most of us, $5 will not change our lives one bit. And yet I can almost guarantee you that you would be experiencing certain FEELINGS associated with each of the above situations.

Welcome to the “impact of emotions” on money. Let’s start with a couple of key definitions:

- Emotion – A mental state that arises spontaneously rather than through conscious effort and is often accompanied by physiological change

- Feeling -- The capacity to experience refined emotions

Look at what is in these definitions:

- Emotions are spontaneous

- Emotions occur without conscious effort

- Emotions are accompanied by physiological change

- Feelings are what occurs when we experience emotions

Now go back up to the recipe for investing success at the start of the article. Do you see any reference to or allowance for emotions in this recipe? Do you see any reference to feelings?

The reason that investors fail is simple:

- Investors have emotions. These emotions manifest themselves in feelings. Investors take ill-advised actions as a result of these feelings.

Your number one key to success as an investor is to learn to deal with the feelings that arise from the emotions that are associated with your investments and avoid harmful actions that these feelings cause you to want to take. This is very easily said and very difficult to do.

There are three main emotions that cause the vast majority of all problems for investors.

Each of these emotions leads to “normal” feelings and “normal” actions. And these “normal” feelings and actions are extremely harmful. The three emotions are:

- Fear

- Greed

- Loneliness

Fear is at the top of the list as it is the emotion that is the deepest rooted and has the potential for the most harm. We evolved to survive. We did so by paying attention to our fears. When the stock market drops 20% fear surfaces as the “survival of our retirement” is at risk and we want to do something. That something is “sell”. And we all know that selling after a 20% drop is normally always the wrong answer. Nonetheless, each time the market starts down, the lemming starts the selling. This phenomenon is one of the major contributors to the delta between investor and investment return.

Greed is next on the list. While its origins do not go back nearly as far as fear, greed has been around for a LONG time. Most of us are always looking to “get ahead”. When we see the opportunity for a fast buck, we don’t pass it up. Hence, when the market is up 20%, we are inclined to ignore any risk and jump into the market with both feet. Again, we know this is normally not correct. And yet we see the lemmings join the market rally just before it reaches the top. And they’re pissed when the market reverses and their greed is repaid with losses. Greed is the second major contributor to the delta between investor and investment return.

The final emotion that causes investors problems, loneliness, may come as a surprise to many until it is explained a bit further:

- Does everyone in the office / in school / at church / at the ball game tend to dress the same way?

Indeed, we all tend to conform as we do not like to be the odd man out. We do not like being alone. Hence, we tend to follow the crowd. So, if the average INVESTOR underperforms the average INVESTMENT, why in the heXX would we ever want to follow the average investor? Put another way, go back to the top of the article and read the recipe for investment success. How many average investors have such a policy and are following it? Do you? If you do, congratulations on being lonely; and, more importantly, on likely being successful! However, if you don’t have an IPS you are likely to follow the crowd to avoid being lonely. Wealthy individuals have their own IPS and don’t follow crowds.

What’s the takeaway from all of the above discussion? Two things:

- Investments are NOT about feelings. Investors are about feelings. Investing is about having a disciplined process that you follow to AVOID the impact of feelings.

- Investments are about knowledge. Investors are NOT about knowledge. We just outlined why investors fail. 99% of the readers will fully comprehend the above information. They will have the knowledge. And they will fail to put this knowledge to use.

So if investments are about knowledge and NOT feelings, what actions should you take after reading this article?

Three things:

- Step back and assess how your emotions are manifesting themselves in feelings in regards to your investments. Most people never even recognize that they have significant feelings regarding their investments.

- Commit to developing and implementing a personal Investment Policy Statement (IPS) to overcome the impact of emotions and feelings. The recipe for success is clearly stated at the beginning of this article. In the words of Nike, just do it

- Decide if you have the necessary discipline to stay the course with your IPS. If you do not have the discipline, you have three choices. (i) Play the game and recognize that emotions and feelings are going to cause you to deviate from the recipe for success. (ii) Stay out of the game as you realize it is not for you. (iii) Enlist the help of others to increase your ability to stay the course with your investments.

While we do NOT have the ability to change our emotions, we do have the ability to change the way we feel about these emotions. More than that, we have the ability to change the way we act on these feelings. Ultimately, it comes down to one of my favorite quotes of all time from Jim Rohn:

- We must all deal with one of two pains—the pain of discipline or the pain of regret.

I sincerely hope that all of the readers of this article experience the pain of discipline – it will mean that they overcame the feelings associated with their emotions and took the necessary steps to a better financial future.

At F5 Financial Planning we focus on helping individuals and families find balance between faith, friends and family, fitness, and finance. We make sure that they have the financial freedom to enjoy those things in life that are important to them. And while we believe the left-brain facts and data are critical; we work with our clients to get them in the right state of mind to focus on the goals they want to achieve.

Some other posts that you might like: